Banks and Insurers to Strengthen 'Five Priorities'

By?ZHONG?Jianli

China's National Financial Regulatory Administration released a guideline for the banking and insurance sectors on May 9 to improve the work of five priority segments — technology finance, green finance, inclusive finance, pension finance and digital finance.

The guideline provides a comprehensive plan for financial institutions to jointly advance these five priorities.

Over the next five years, a multi-layered, widely accessible, diversified, and sustainable service system for the five priorities should be basically formed in the banking and insurance sectors, and drive the development of new quality productive forces.

To better serve sci-tech innovation, the guideline emphasizes enhancing the quality and efficiency of financial services, specifically providing comprehensive financial services throughout the life cycle of tech-based enterprises.

It advocates increasing credit lending within manageable risks, and meeting the medium and long-term financing needs of manufacturing industries. Advancing intellectual property financial services is also a priority.

Another focus is the "dual-carbon" goal, which involves strengthening the green financial system. This includes supporting energy conservation, emission and carbon reduction, afforestation, and disaster prevention in key industries and areas.

A solar?thermal power station?in?northwest China's Qinghai province. (PHOTO: XINHUA)

The guideline calls for developing green financial products and services, exploring financing through environmental rights like carbon emission quotas, and promoting green insurance mechanisms to advance environmental protection, climate change initiatives, and the growth of green industries and technologies.

To enhance inclusive financial services, efforts should be made to offer sustained financial support to private, small and micro-businesses, and individual merchants to contribute to the comprehensive revitalization of rural areas.

To accelerate the development of pension finance, increased financial support should be given to the healthcare and elderly care industries to develop the "silver economy." Financial institutions should make their products and services more friendly to the elderly to improve the latter's service experience.

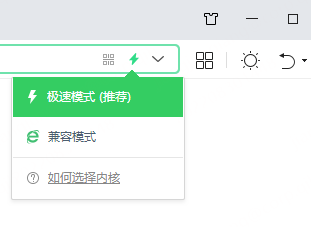

Finally, advancing digital finance is crucial. Banking and insurance institutions are encouraged to make digital transformations to improve their operational capabilities, enhance service quality, and reduce costs. Strengthening data security, network security, and risk management related to technological advancements is key to mitigating associated risks, according to the guideline.

The document reflects China's continuous efforts to promote high-quality development of the banking and insurance sectors and meet the diverse financial needs of the real economy and the public.